Examine This Report about Ach Payment Solution

Table of Contents4 Simple Techniques For Ach Payment SolutionEverything about Ach Payment SolutionGetting My Ach Payment Solution To WorkFacts About Ach Payment Solution Revealed

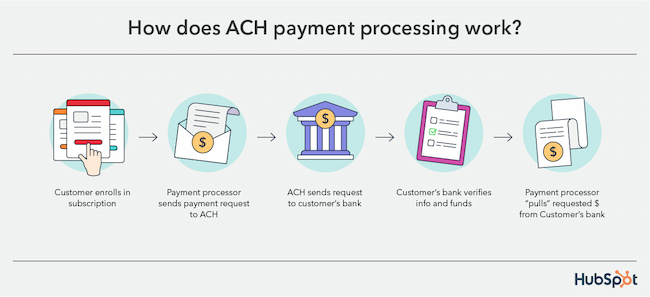

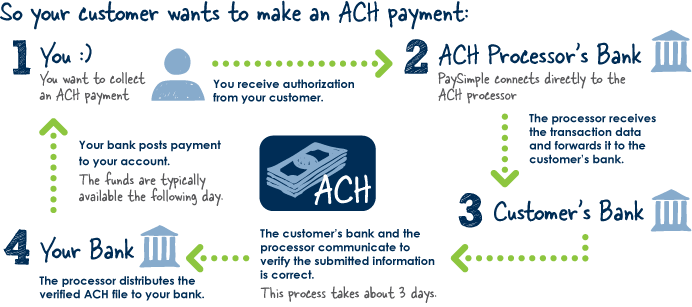

The Federal Reserve after that sorts all the ACH documents and after that transmits it to the receiver's financial institution the RDFI.The RDFI then refines the ACH data and also debts the receiver's (Hyde) account with 100$. The example above is that of when Jekyll pays Hyde. If Hyde needs to pay Jekyll, the same procedure happens in opposite.The RDFI uploads the return ACH data to the ACH network, along with a factor code for the mistake. ACH settlements can offer as a fantastic alternative for Saa, S businesses.

With ACH, given that the transaction processing is recurring and automatic, you would not need to wait on a paper check to show up. Likewise, because clients have actually licensed you to collect payments on their behalf, the flexibility of it allows you to accumulate single settlements too. Say goodbye to awkward emails asking consumers to pay up.

Bank card repayments stop working due to different reasons such as expired cards, obstructed cards, transactional mistakes, etc. Often the customer might have exceeded the credit line and also that could have brought about a decline. In case of a financial institution transfer by means of ACH, the checking account number is used in addition to a consent, to charge the client as well as unlike card deals, the possibility of a bank transfer failing is very low.

Ach Payment Solution for Dummies

Account numbers seldom transform. Unlike card deals, bank transfers stop working just for a handful of reasons such as not enough funds, wrong bank account info, and so on. The two-level confirmation procedure for ACH settlements, makes sure that you maintain a touchpoint with consumers. This consider for churn because of unknown factors.

This secure process makes ACH a reliable option. If you're taking into consideration ACH, head below to know just how to approve ACH debit settlements as an on-line company. For every charge card purchase, a portion of the cash entailed is divided across the various entities which allowed the settlement (ach payment solution). A major piece of this cost is the Interchange charge.

In situation of a deal transmitted using the ACH network, given that it directly deals with the financial network, the interchange cost is around 0. 5-1 % of the overall transaction.

How Ach Payment Solution can Save You Time, Stress, and Money.

For a $10,000 transaction, navigate to these guys you will certainly pay (0. The cost for a typical ACH deal ranges someplace around 0. The real TDR (Purchase Price Cut Rate) for ACH varies according to the payment portal utilized.

Smaller transfer costs (generally around $0. 50 per transaction)Bigger deal fees (2. 5% to 3. 2% per deal)Repayments are not automated, Automated repayments, Take more time, Take much less time, Refine extensive and also therefore not as very easy to utilize, Easy to utilize, ACH costs much less and is of great value to sellers yet the difficulty is obtaining a multitude of users onboard with ACH.

Freelancing platform Upwork has actually used interesting strategies to drive ACH fostering. They bill 3% even more on the credit scores card transactions. Additionally, they bill high quantity (greater than $1000) individuals with just $30 flat cost for endless ACH purchases. You can drive raised fostering of ACH repayments over the long-term by incentivizing customers utilizing benefits as well as advantages.

ACH transfers are electronic, bank-to-bank cash transfers refined with the Automated Clearing Up House (ACH) Network. According to Nacha, the organization in charge of these transfers, the ACH network is a set processing system that financial institutions and other banks use to accumulation these transactions for processing. ACH transfers are electronic, bank-to-bank cash transfers refined via the Automated Cleaning Home Network.

Indicators on Ach Payment Solution You Need To Know

Direct repayments involve money heading out of an account, including expense settlements or when you send out cash to somebody else. ach payment solution. ACH transfers are hassle-free, quick, and also commonly totally free. You might be limited in the variety of ACH transactions you can start, you might sustain additional costs, and there might be delays in more info here sending/receiving funds.

Obtaining your pay through straight deposit or paying your expenses online through your link savings account are simply 2 examples of ACH transfers. You can likewise use ACH transfers to make single or persisting deposits into an specific retired life account (INDIVIDUAL RETIREMENT ACCOUNT), a taxed brokerage account, or a college financial savings account. Entrepreneur can additionally use ACH to pay suppliers or get payments from clients and clients.

Nacha reported that there were 29 billion settlements in 2021. That's an increase of 8. 7% from the previous year. Person-to-person and business-to-business transactions also increased to 271 million (+24. 9%) as well as 5. 3 billion (+21%), respectively, for the very same duration. ACH transfers have many uses as well as can be more cost-efficient and user-friendly than creating checks or paying with a credit score or debit card.

Comments on “8 Easy Facts About Ach Payment Solution Explained”